What would be the effect of taking all the wealth from billionaires and distributing it to the poorest in the world

This is a highly complex hypothetical scenario with a range of potential economic and social outcomes. Here are some key points to consider:

Magnitude of Redistribution:

Billionaires are estimated to hold roughly $12–13 trillion in wealth, which is about 2–3% of global wealth. If that amount were distributed among the poorest people in the world, the per-person benefit would depend on how many people qualify as “the poorest.” For example, if you distributed $12 trillion evenly among 2 billion people living in extreme poverty, that would provide roughly $6,000 per person—a sum that could potentially transform individual lives in terms of access to education, healthcare, and basic needs.

Short-Term Benefits:

- Poverty Alleviation: An infusion of cash could help lift many people above the poverty line, improve living standards, and stimulate local economies.

- Increased Consumption: With more disposable income, recipients might boost demand for goods and services, which can have positive knock-on effects in local markets.

Potential Economic Disruptions:

- Asset Liquidation Issues: A large portion of billionaire wealth is tied up in assets like stocks, real estate, or business equity. Liquidating these assets rapidly to free up cash could lead to dramatic market volatility, causing asset prices to collapse.

- Investment and Growth: Billionaires and their companies often play a significant role in investing in innovation, research, and business ventures. Removing this capital could reduce the funds available for investment, potentially slowing economic growth and job creation over the long term.

- Inflationary Pressures: A sudden increase in disposable income among a large population, without a corresponding increase in the supply of goods and services, might contribute to inflation in certain regions.

Social and Political Consequences:

- Economic Stability: The forced redistribution of wealth on such a scale would likely lead to significant political and economic upheaval, as markets and institutions adjust to the shock.

- Long-Term Policy Considerations: While a one-time wealth transfer might address immediate poverty, lasting improvements would require systemic reforms—such as investment in education, infrastructure, and healthcare—to ensure sustainable development.

Implementation Challenges:

- Practicality: In practice, forcibly taking and redistributing wealth would face enormous legal, logistical, and political hurdles.

- Inequality and Incentives: The removal of wealth from those who have been highly productive in economic terms might have unintended consequences on incentives for innovation and entrepreneurship.

In summary:

While redistributing billionaire wealth could provide a significant short-term boost to the poorest populations—potentially lifting millions out of extreme poverty—the broader economic ramifications could be severe. Market instability, reduced investment, and potential inflation are all risks that could undermine long-term economic growth. A sustainable solution to global poverty likely requires comprehensive policy measures that address structural inequalities, rather than a one-off redistribution of wealth.

This analysis is based on a simplified model; real-world economic systems are complex, and the actual outcomes would depend on numerous variables and the details of how such a redistribution was implemented.

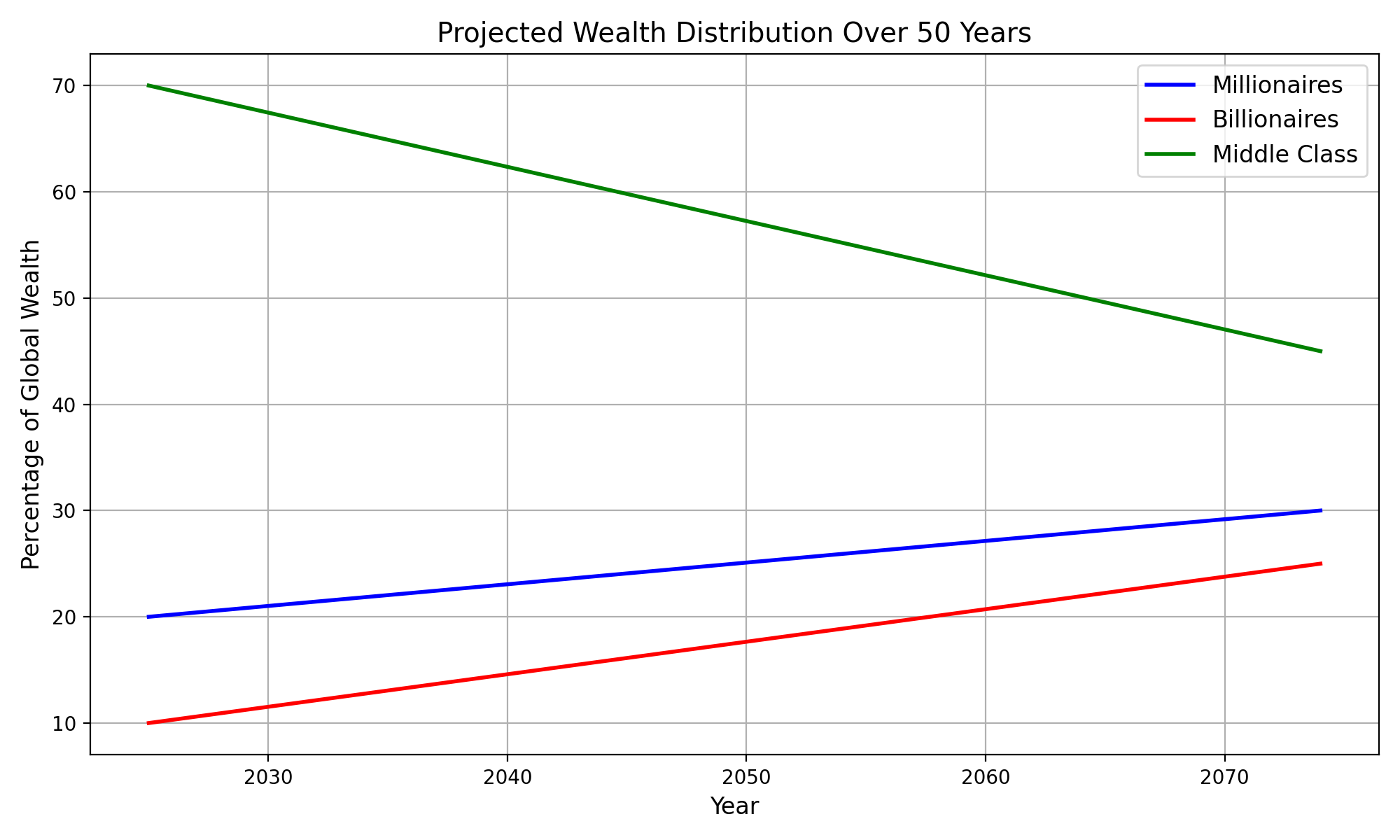

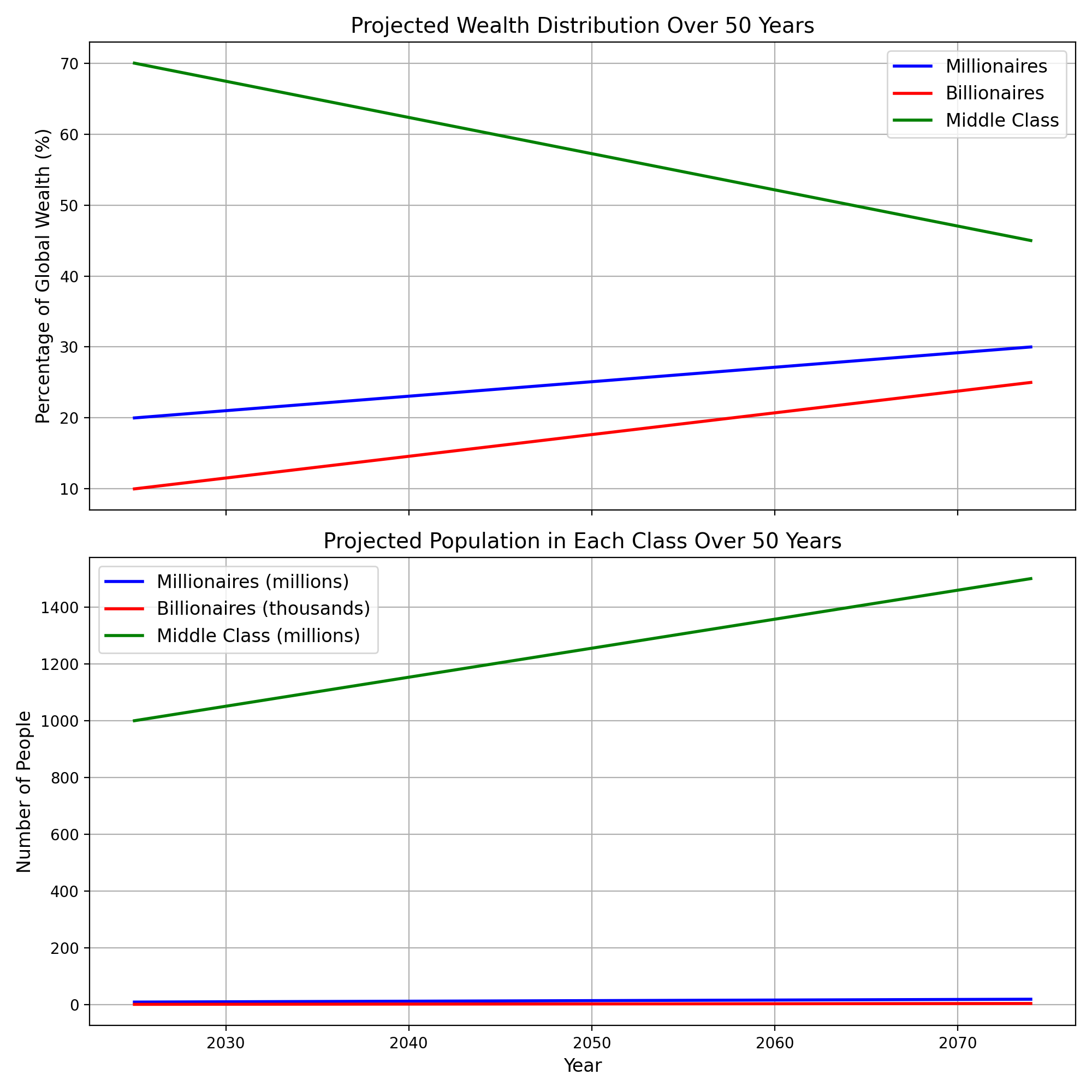

What is the trend?